If you’re separated but not legally divorced, you may be worried about what that means…

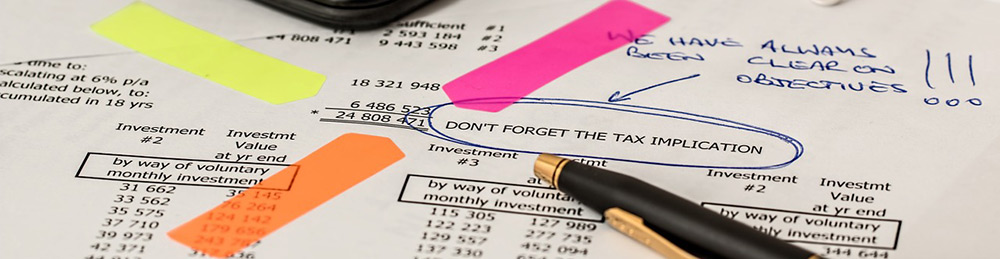

Filing your taxes is confusing enough, but during a separation or after a divorce, it can be overwhelming. Your filing status changes and you’re probably wondering how division of assets, alimony, and child support factor into your return.

Fortunately, it’s not as scary as it seems. With the right knowledge, you can avoid any expensive surprises at tax time.

Tips for Filing Taxes After a Divorce

1. Separated vs. Divorced at Tax Time

Many people are a little confused about what it means to be separated at tax time. In the eyes of the IRS, if you are not officially divorced by December 31 of the tax year, you are still married. If your divorce is finalized by December 31 of the tax year, the IRS considers you to be divorced for the entire year and you must file individually.

If you are separated, you may file as an individual, but you can still file jointly. If you have children and still get along reasonably well with your former spouse, this may be worth exploring. Since your child(ren) can only be claimed by one parent, filing jointly allows you both to claim the child tax credit. Individual tax rates also tend to be higher than married filing jointly rates, so filing jointly one more time will likely save you money. (If you decide to file jointly while separated, be sure to discuss how a refund will be divided.)

2. Update Your W-4

Your W-4 tells your employer how much tax to withhold from each paycheck based on your family size. When you get divorced, your tax withholding should change since your family size has changed. Making sure your withholding rate is accurate will put more money in your pocket every paycheck and make tax time easier.

3. Alimony is No Longer Subject to Taxes

In 2017, sweeping tax reform changed the way alimony factors into your tax return. Previously, alimony was considered taxable income by those who received it and tax deductible by those who paid it. As of tax year 2019, alimony is no longer tax deductible and it cannot be taxed as income. In addition, attorney’s fees related to securing alimony are no longer tax deductible.

If your divorce agreement was signed by December 31, 2018 and have been receiving or paying alimony, you may be grandfathered in. If you divorced on or after January 1, 2019, the new law applies.

Similarly, child support is not tax deductible by the payor and for the person receiving it, it cannot be taxed as income.

4. The Child Tax Credit Has Changed

As we’ve discussed, who claims the children on their tax return is often a point of contention for divorcing couples. After all, claiming child(ren) on your tax return can result in a bigger refund.

It’s important to know that the same tax laws that changed the rules surrounding alimony also changed the child tax credit. The child tax credit, which offsets your taxes owed, dollar for dollar, doubled from $1,000 to $2,000.

The 2017 tax law also skyrocketed the standard deduction. Starting in 2019, single taxpayers will get a standard deduction of $12,000, up from $6,350 in 2017.

Take the time to come to an agreement with your soon-to-be-ex spouse regarding who will claim the children on their tax return. Talk it over with a financial advisor and seriously consider who would benefit most from these tax breaks.

5. Property Division is Tax-Free

Sometimes people turn down assets during property division because they’re afraid they’ll get a big tax bill next time they file. This may seem smart, but it’s misguided.

Any income from property division is considered a tax-free exchange of property by the IRS. Homes, vehicles, land, and even funds are not eligible to be taxed after divorce. (Funds from a 401K or stocks are the exception. We recommend speaking with a financial advisor if you are giving or receiving funds from any retirement plan or dividing stocks.) Fight for what is rightfully yours and don’t worry about getting a big tax bill.

6. Sell Your Home While You’re Still Married

If you’re planning on selling your home, it’s best to do it while you’re still married. Selling as a married couple has a major tax benefit: IRS exempts the first $500,000 of gains on the sale of a primary home for married couples that file jointly. If you file individually, the exemption is only $250,000.

In other words, if you sell your home for $700,000 while still married, the IRS will not tax $500,000 of your gain. You’ll only owe on $200,000. If you sell after your divorce, you’ll owe taxes on $450,000. Keep in mind that this only applies to a primary residence that you’ve lived in for at least two years. Vacation homes or rental properties are not subject to these tax breaks.

7. Legal Fees (Usually) Aren’t Tax Deductible

Attorney fees are considered personal expenses and are not tax deductible. In addition, you can’t deduct fees for counseling or litigation.

You may be able to deduct legal fees if you can prove that those expenses were related to doing or keeping your job. Another way you may be eligible to deduct attorney fees are if those fees are associated with receiving property. Since those fees went toward something that increased your taxable income, they may be deductible. This is a very tricky situation and we recommend consulting an experienced attorney or financial advisor to determine whether legal fees are deductible for you.

8. Understand Your Social Security Benefits

Social security benefits aren’t something that most divorced couples have to worry about, but if you and your soon-to-be-former spouse are 62 or older, you need to be aware of the laws around it.

Divorced people 62 or older may be eligible to claim SS benefits based on their former spouse’s income. The criteria for this are as follows:

- You must be entitled to claim social security or disability benefits

- Your former spouse cannot be remarried

- You must have been married for at least 10 years

- The benefits that you are entitled to receive based on your own work is less than the benefit you would receive based on your former spouse’s work

This will not impact your former spouse’s benefits, but it can greatly increase your benefits, thereby increasing the amount that you’ll be taxed.

9. Hire a Professional

DIY tax preparation is popular but if you’ve gotten a divorce in the past year, we highly recommend having them professionally done. You don’t want a tax headache on top of the stress of a divorce!

Make The Doyle Law Group Your Partner in Divorce

While we can’t help you file your taxes, we can help ensure your finances are in order during and after the divorce process. To schedule your consultation, call us at (919) 263-5629 or fill out the contact form below.